Student Loan Relief Will Allow Stability for Current Higher Education Students

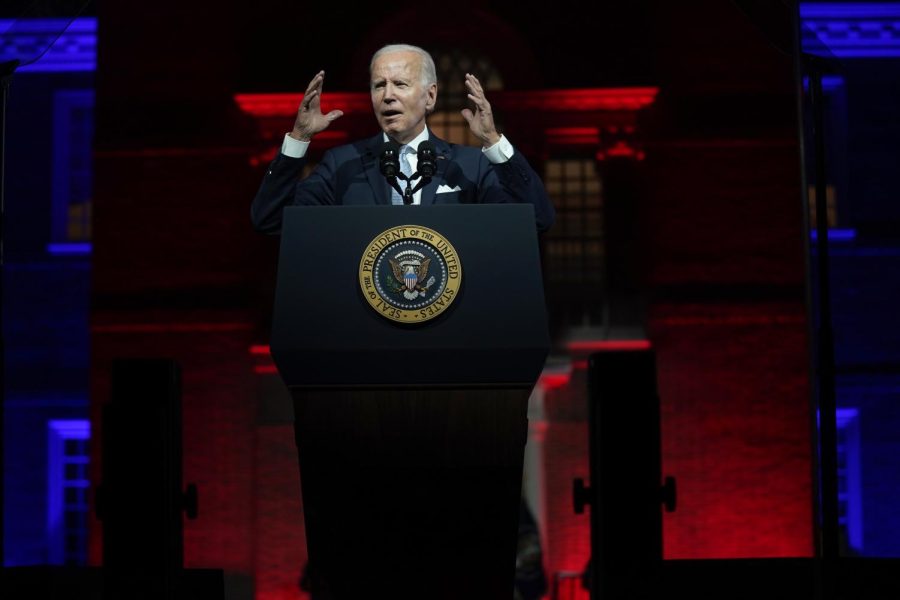

President Joe Biden gives a speech outside of Independence Hall in Philadelphia on Sept. 1.

September 2, 2022

After a long two years of student loan repayment pauses, higher education students finally have a solution that will help – loan cancelation. It will benefit most higher education students, and the only people who are mad are ones who shouldn’t even be complaining.

Earlier this week, President Biden had finally announced that the Department of Education will finally cancel student debt for most students. Student debt cancelation was one of his presidential campaign pledges, and Biden actually did it.

Over the past few years, the cost for higher education has exponentially increased to a point where it’s just sad and insulting. According to the National Center for Education Statistics, tuition at the University of Southern California had a $3,000 increase over the span of three years. It’s obscene.

Obviously, students can’t pay that. Most students weren’t able to work during COVID-19 lockdowns. It’s a huge struggle for students coming out of the COVID-19 era and into post-COVID. It’s important that they did this earlier, but better now than ever I guess.

So how much is being canceled among students? If you were given a Pell Grant, $20,000 will be canceled; $10,000 without a Pell Grant. But this only applies if your parents make less than $125,000 individually or $250,000 married. This is means around 45% of borrowers will have their loans fully canceled, according to Biden.

None of the high-income families will be getting relief, which is honestly a slap in the face to those students who have parents who make more than that and don’t help pay for tuition. It does help ensure rich higher education students who have debt don’t get assistance and it all goes to lower-income/middle class families, but there should be some exceptions.

The ones who are mad, however, are the people in their mid 30s and 40s who didn’t experience anything at all that would have impacted repayment. They shouldn’t even be mad, but I find it fun to see their Facebook posts in all caps.

“Higher education is a choice” is something I see a lot on Facebook. Yeah, it is. People know that. What wasn’t a choice? COVID and rising higher education costs. I don’t remember deciding on whether I would be learning online or increasing tuition costs.

Then you have those who did repay their loans on time were able to do so. Good for you. Want a gold star? Not everyone is able to do so. People are in debt, and there are other people other than you. And honestly, those people are the selfish ones who only dare to help themselves.

Why are they mad? “It’s morally repugnant for the government to relieve a borrower from a loan burden by placing it on someone else,” a Twitter user posted.

At the same rate, they also do pay for the US debt that the person from Twitter didn’t cause, so why aren’t they mad about that? Right, it’s only for things they don’t like. They’ll get over it in a week.

It’s exciting to see that current higher education students will finally have some relief after a hard past two years with loans, interest, and debt for their education. These students shouldn’t have to pay so much money for something the US relies on so heavily nowadays. I hope Biden continues his campaign promises for further cancelation and allows a pathway for future students.